There’s nothing in the 2022-23 Federal Mini Budget that will create a UK style crisis. The stage 3 tax cuts legislated to commence on 1 July 2024 are not mentioned, and most funding initiatives appear to be a reallocation of previous Government initiatives.

With seven months before the 2023-24 Budget released in May 2023, this Budget is a shuffling of the deck not a new set of cards.

Taxation

Personal income tax – No changes

No changes to already legislated stage 3 tax cuts that are due to take effect on 1 July 2024.

Superannuation

Deferring relaxation of residency requirements – SMSFs

The government will defer the 1 July 2022 start date of the 2021–22 Budget measures which proposed relaxing the residency requirements for self-managed funds. The revised start date is the financial year commencing on or after the date of Royal Assent of the enabling legislation. This aims to provide some certainty to fund trustees and advice practitioners.

Residency tests

To gain favourable tax concessions, superannuation funds must satisfy some residency tests, including the Central Management & Control Test, and the Active Member Test. Failing these tests results in the fund being classed as non-complying, meaning its income and assets are taxed at 45%.

The 2021-22 Budget proposed to relax the residency requirements for SMSFs by extending the time trustees can be temporarily absent from Australia while continuing to meet the Central Management & Control Test (from two to five years). In addition, the 2021-22 Budget proposed to abolish the Active Member Test altogether, as this test unfairly restricts contributions being made to an SMSF when members are overseas.

Under the proposals, members of SMSFs will have the opportunity to continue contributing to their preferred fund when undertaking work or pursuing other activities overseas.

Downsizer contributions – lowering qualifying age

The government will allow more people to make Downsizer superannuation contributions, by reducing the minimum eligibility age from 60 to 55 years. This measure will take effect from the start of the first quarter after Royal Assent of the enabling legislation.

The maximum Downsizer contribution continues to be $300,000 per eligible person.

Child Care

Child Care Subsidy – extending eligibility

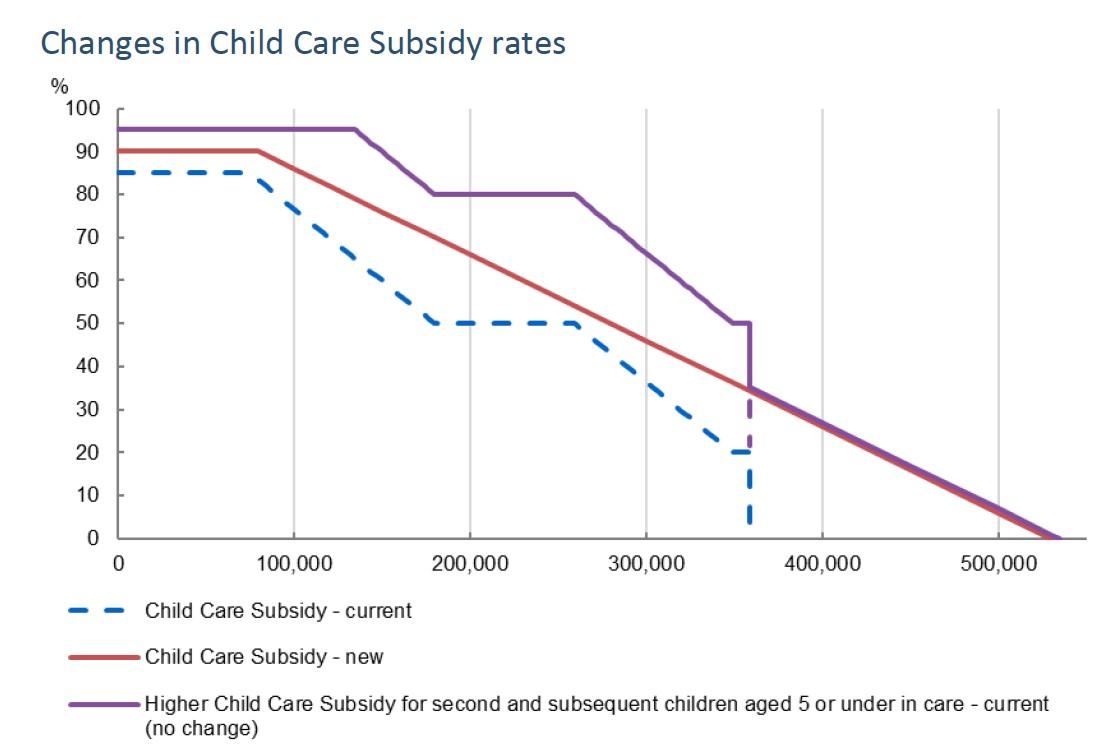

From 1 July 2023, Child Care Subsidy rates will increase from 85% to 90% for families earning less than $80,000. Subsidy rates will then taper down 1% for each additional $5,000 in family income, until the maximum income threshold of $530,000 is reached. Families will continue to receive the existing higher subsidy rates of up to 95% for their second and subsequent children in care, who are under age 5.

The below graphic compares the proposed (new) subsidy rate with the current subsidy. The x axis represents family income. You can find the definition of income here.

Paid Parental Leave

Extending the number of weeks

The government is proposing numerous changes to the Paid Parental Leave scheme.

Currently, families can access 18 weeks of Paid Parental Leave under the scheme. This comprises of 16 weeks for the birth parent (or an adoptive parent) and 2 weeks for their partner.

It is proposed that the number of weeks will increase to 20 weeks in 2023-24, 22 weeks in 2024-25, 24 weeks in 2025-26 and 26 weeks from 2026-27.

Introducing greater flexibility

Here are some of the 1 July 2023 proposals aimed at making the scheme more flexible:

- Parents will be able to take government-paid leave up to the maximum number of weeks and can use it flexibly between them.

- Single parents will be able to access the full entitlement each year.1

- Parents will be able to take government-paid leave in blocks as small as a day at a time, with periods of work in between, so they can use their weeks in a way that works best for them.

- There will be assigned ‘use it or lose it’ weeks for each parent, designed to encourage each of them to take that portion of the parental leave.

- Either parent will be able to claim Paid Parental Leave first and both parents can receive the payment at the same time as any employer-funded parental leave.

Broadening eligibility

Eligibility will be expanded through the introduction of a $350,000 family income test, which families can be assessed under if they don’t meet the individual income test. The definition of income can be found here.

Pharmaceutical Benefits Scheme

From 1 January 2023, the government is proposing to decrease the maximum co-payment under the PBS from $42.50 to $30 per script, a 29% reduction.

Pensioners

Freeze deeming rates

The Budget looks to freeze income test deeming rates at their current levels for a further two years, until 30 June 2024.

Pensioner relief for downsizing

The Budget contains two key measures to incentivise pensioners to downsize their housing.

- Extending the assets test exemption from 12 months to 24 months, following the sale of their principal dwelling. This will double the time pensioners have to use the sale proceeds to acquire a new principal dwelling, without these funds being counted towards the assets test.

- Changing the income test treatment of principal dwelling proceeds, so that it will only apply the lower deeming rate (currently 0.25%) to these proceeds when calculating deemed income for 24 months after the sale.

Age Pension – Work Bonus

The Work Bonus increases the amount an eligible pensioner can earn from work before it affects their pension rate.

Under a recent proposal, a one-off $4,000 credit will be made from December 2022 to the Work Bonus income bank for pensioners. This one-off top-up will increase the amount pensioners can earn from $7,800 to $11,800 this financial year, before their pension is reduced. It will need to be used in the current 2022-23 financial year, meaning the Work Bonus income bank from 1 July 2023 resets to $7,800.

Commonwealth Seniors Health Card

Lifting income thresholds

The income threshold for the Commonwealth Seniors Health Card will be increased from $61,284 to $90,000 for singles and from $98,054 to $144,000 (combined) for couples.

1. The Budget literature references “each year”, however it remains uncertain what this means given government-paid leave is a payment to a primary carer of a newborn.