Cryptocurrency has seen yet another large uptake amongst users throughout the 2021 financial year. A recent article from the Australian Financial Review suggests that now one in five Australians (14%) have owned some form of the digital currency.

However, there is still a lot of confusion about when and what to include in your tax return when it comes to the acquisition and disposal of cryptocurrency. A common misconception is that you only consider tax consequences after you withdraw your fiat (Australian Dollars) currency off a cryptocurrency exchange.

Yet this is not correct, and there are several situations that would trigger a taxable event.

When do I have to report?

Cryptocurrency disposal events are reported as part of your income tax return each year. You may be assessed as either:

– An investor (capital gains); or

– A trader (revenue)

For the purposes of this blog, we will focus primarily on those treated as investors. This is because the vast majority of those engaged in cryptocurrency will be considered as investors for income tax purposes.

What do I need to include in my tax return?

In your tax return you will need to report any capital gain or loss events that may occur on the disposal of your cryptocurrency holdings. These events occur anytime you dispose of a cryptocurrency asset. The two most common ways this can occur are:

– Selling your cryptocurrency and receiving fiat currency in return (such as Australian Dollars); or

– Utilising a cryptocurrency asset held to purchase another cryptocurrency asset. For example: purchasing Litecoin using Bitcoin held. When this event occurs the gain or loss is calculated based on the Australian Dollar equivalent of the cryptocurrency held at the time of exchange.

Timeline and Example:

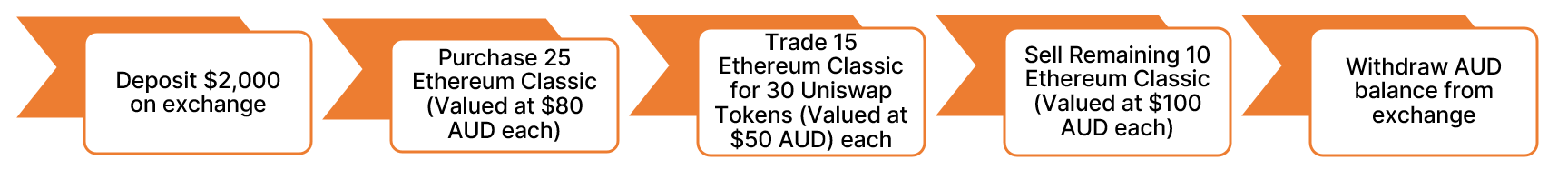

The above example details how a typical set of transactions may take place when someone is acquiring and disposing of cryptocurrency. In the above example two capital gains events occur:

The above example details how a typical set of transactions may take place when someone is acquiring and disposing of cryptocurrency. In the above example two capital gains events occur:

1. On exchange of the Ethereum Classic to Uniswap. The Ethereum Classic were acquired at $80 each and at the time of disposal were equal to $100 each. Therefore, they have made a gain of $20 for each token or $300 (less exchange fees). The Uniswap tokens will have an acquisition cost of $50 AUD each as this was their value at the date of purchase.

2. A second disposal event has occurred when they have sold the remaining balance 100 Ethereum Classic at $100 each. In this instance they have also made a gain of $20 per Ethereum Classic token or $200 total (less exchange fees).

The total capital gain for this example to be included in the tax return is $500 (less exchange fees). If the above assets were held longer than 12 months, they would also be entitled to the Capital Gains Discount of 50%. It is important to note that no taxable event has occurred on the withdrawal of the Australian Dollars from the exchange as the taxable events have already taken place in the previous two steps.

How can Accura help?

The above example is one that is relatively simple and easy to calculate. However, it is relatively rare that cryptocurrency investing is so simple. Often transactions occur in fractional amounts (such as $100 AUD = 0.022224486 Ethereum as of writing this blog). In addition, the frequency of which transactions are traded or sold can create great difficulty in calculating any gains or losses.

Accura can take the hard work out of this for you and calculate any gains or losses to be included in your income tax return. Having recently partnered with Crypto Tax Calculator we are able to leverage their software to ensure accuracy in these calculations as well as tackle some of the more difficult to manage tax implications of cryptocurrency such as trading stock rules, airdrops, staking and chain splits.

If you need help with your cryptocurrency tax implications, please contact our in office Crypto expert Chris Cornish on 08 9387 0038 or chris@accura.com.au