The recent Federal Budget announced has left us feeling underwhelmed with its minimal changes and a few headline-grabbing initiatives.

While there may not have been any groundbreaking policies, it’s still crucial to understand the implications. To assist we have created a Cheat Sheet, please click here to download.

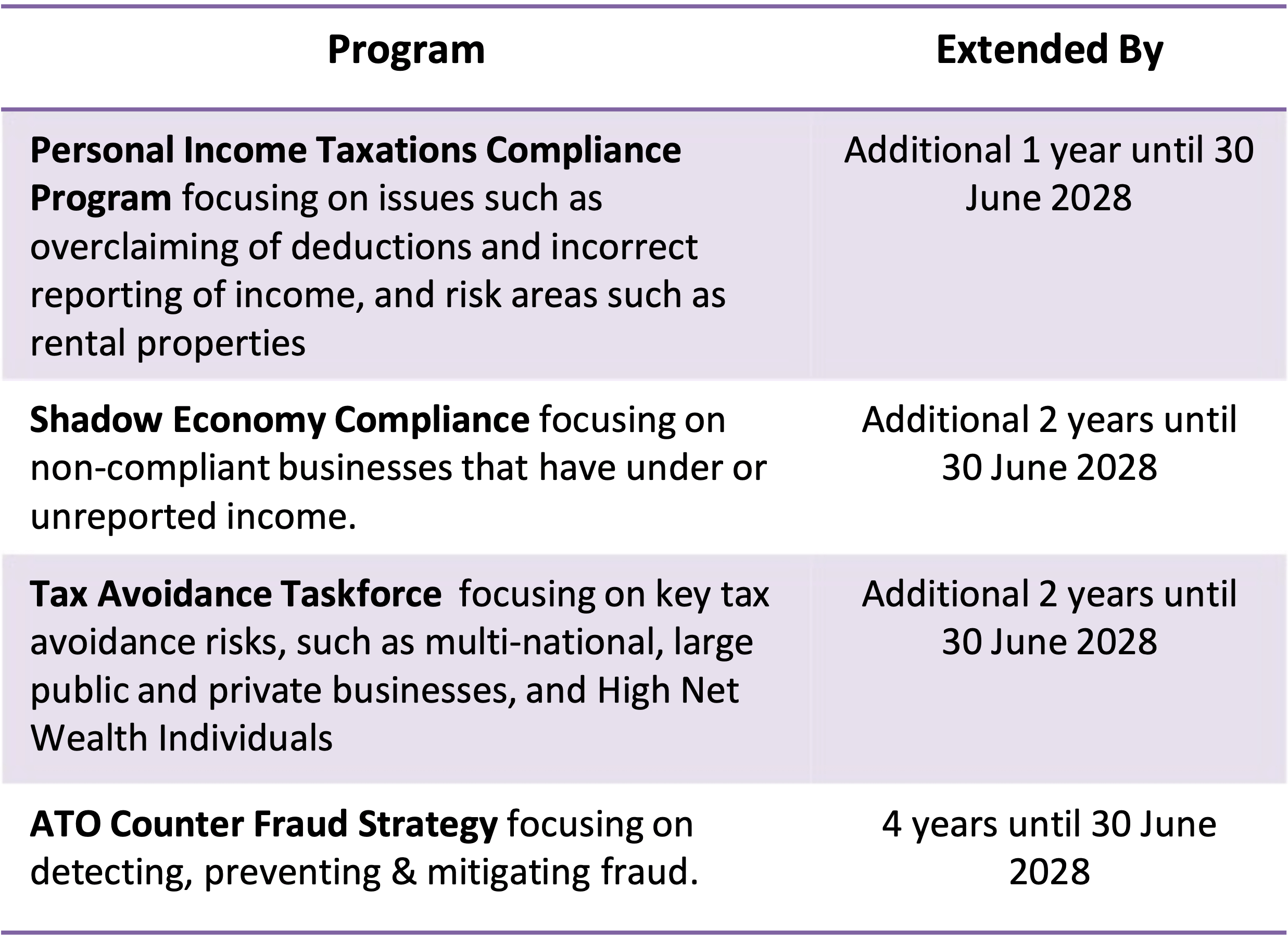

Extending & Funding Compliance Programs

What? Extending Personal Income Tax Compliance, Shadow Economy Compliance, Tax Avoidance Taskforce, and funding new ATO Counter Fraud Strategy.

Who? Taxpayers, Tax agents

UPDATED MEASURE: Anti-avoidance extension

Previous measure: Relating to Part IVA, the ‘Tax Integrity – expanding the general anti-avoidance rule in the income tax law’ measure was to apply to income years commencing on or after 1July 2024, regardless of whether the scheme was entered into before that date.

Amendment: Start date will apply to income years commencing on or after the day the amending legislation receives Royal Assent, regardless of whether the scheme was entered into before that date.

Digital ID

What? $288m committed to support the delivery and expansion of Australia’s Digital ID System so more Australians can realise the economic, security and privacy benefits of Digital ID.

When? From 1 July 2024

Instant Asset Write Off (IAWO) for Small Businesses

What? IAWO will increase to $20,000 for assets that are first used or installed ready for use between 1 July 2024 to 30 June 2025, instead of reverting to $1,000. The ‘lock-out’ rules for small businesses opting out of the simplified depreciation rules remain suspended until 30 June 2025 as well.

Who? Small businesses with turnover <$10m

When? 1 July 2024 to 30 June 2025

Personal Income Tax Cuts

What? The legislated tax cuts will apply from 1 July 2024, changing the tax brackets & rates for individual tax payers.

Who? Individuals

When? From 1 July 2024

UPDATED MEASURE: Commissioner’s discretion for resurrected tax debts

What? Recently, the ATO has been publicly criticised for ‘resurrecting’ old tax debts which had previously been placed on hold as being ‘uneconomical to pursue’.

Who? Individuals, Small businesses, Not for Profits (NFPs)

Amendment: Commissioner is given discretion to not use a taxpayer’s refund to offset old tax debts, where the Commissioner had put that old tax debt on hold prior to 1 January 2017.

Foreign resident CGT changes

What? Amendments will apply to CGT events commencing on or after 1 July 2025 to:

- Clarify and broaden types of assets that foreign residents are subject to CGT on

- Amend point in time principal asset test to a 365 day testing period

- Require foreign residents disposing of shares and other membership interests >$20 million in value to notify the ATO, prior to the transaction being executed

New ATO notification process will improve compliance with foreign resident CGT withholding rules.

Who? Foreign residents

When? From 1 July 2025

Energy Bill Relief Fund

What? All households will receive a $300 rebate and eligible small businesses will receive a $325 rebate for cost of living relief.

Who? Individuals, Families, Small businesses

When? 1 July 2024 to 30 June 2025

HECS-HELP debt indexation

What? The Government will limit indexation on Higher Education Loan Program debts (and other student loans) to the lower of CPI or the Wage Price Index.

Who? Individuals, Students

When? From 1 June 2023 (subject to passing legislation), but will be applied retrospectively.

Superannuation on Paid Parental Leave (PPL)

What? Superannuation will be paid on Commonwealth government-funded PPL for births and adoptions on or after 1July 2025, at the Superannuation Guarantee rate. $10m will also be provided over two years from 1 July 2024 to support small business employers in administering PPL.

Who? Individuals, Families, Small businesses

When? From 1 July 2024

Modernising Digital Assets and Payments Regulation

What? $7.5m provided over 4 years, then $1.5m ongoing, to improve competition and consumer protections for services enabled by new technology.

- Develop legislation to regulate platforms that hold digital assets

- Introduce a new regulatory framework for payment service providers, including digital wallets

Investing in a Future Made in Australia

What? Investment package that seeks to promote and regenerate Australia’s domestic industries and create a sustainable and modern economy.

Key areas to invest:

- Making Australia a renewable energy superpower through investing in industries such as hydrogen, green metals & clean energy technologies.

- Developing skilled and diverse workforce and trade partnerships

- Strengthening and improving the process of environmental approvals

- Providing additional funding of ASIC, APRA and Treasury to deliver a sustainable finance framework

- Investing in Australia’s innovation, science and digital capabilities.

What’s NOT in the budget?

- Division 7A reform

- Tax residency reform for individuals and companies

- Review of the CGT rollovers & demerger rollover relief

- CGT concessions for small business (the small business CGT concessions and Small Business Restructure Rollover)

- Trust reimbursement integrity rules (section 100A)

- Taxation of trusts

- Previously shelved policies (e.g. restricting negative gearing or halving the general 50%CGT discount)

You can find all the above information in our handy cheat sheet which you can download here.

Should you have any questions or need personalised advice in respect to the budget, then please don’t hesitate to reach out to us.